Sign up to our newsletter Subscribe

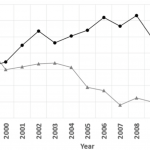

Analysing Global Immunisation Expenditure

Sign up to our newsletter Subscribe

This new publication sets out the arguments in favour and against the introduction of a hypothecated tax to fund the UK National Health Service (NHS). In June 2018 the UK Government announced an increase of 3.4% per annum in…

This new publication sets out the arguments in favour and against the introduction of a hypothecated tax to fund the UK National Health Service (NHS).

In June 2018 the UK Government announced an increase of 3.4% per annum in spending on the NHS in England for each of three years. It indicated that taxes will rise to pay for this. Debate has increased as to whether a separate (hypothecated) tax should be introduced to fund the NHS. The Kings Fund has published this year on the topic. OHE published an academic review sometime ago.

This OHE publication by Nick Timmins, a senior fellow at the Institute for Government and the Kings Fund, sets out arguments in favour and against. It is based on the seminar he gave at OHE in July 2018. The issues he explores include:

He concludes by quoting a John Appleby blog which argues that the key decision is to agree (or not) to spend more money on the NHS. Creating a new tax is a distraction from this.

I would point out that Layard in an earlier BMJ Soundcloud debate with Appleby makes the point that the existence of the hypothecated tax will change the nature of the political debate about NHS funding. Of course, even if one accepts that argument, the practical issues Nick Timmins raises still have to be addressed.

Nick Timmins OHE Seminar Briefing is available here.

Citation

Timmins, N. (2018) Securing Funds for the Proposed NHS Multi-year Funding: The Feasibility of Using a Hypothecated Tax. London: Office of Health Economics.

Related research

An error has occurred, please try again later.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!